Daytradefeed

No In-built rules. Play any card games

Sponsored by: www.anycard.games No In-built rules. Play any card games just like holding cards in your hand with upto 10 players online!! Free to join and free joining in-game cash Bonus for limited time!!

NASDAQTrader.com

Fresh off the Blog – Warrior Trading

INO.com Trader's Blog

Blog – Simpler Trading

Blog – Option Alpha

– Tradingsim

Saturday, October 31, 2020

Gold Miners: Beautiful Pictures

After a well-deserved correction of nearly 3 months, the gold stock sector is still flashing positive signs beneath the surface, as the correction matures. The correction that began in August amid the ‘Buffett Buys a Gold Stock!‘ tout has now ground on for nearly 3 months. As noted in the NFTRH 626 Opening Notes segment: “Thus far […]

The post Gold Miners: Beautiful Pictures appeared first on INO.com Trader's Blog.

Friday, October 30, 2020

From McSweeney’s, “Lest We Forget the Horrors: A Catalog of Trump’s Worst Cruelties, Collusions, Corruptions, and Crimes.”

During a speech at a factory in Ohio, Trump wondered aloud whether Democrats had committed treason against the United States for withholding their applause during his State of the Union Address.

↩︎ McSweeney's Internet Tendency

How long have you been reading TMN? Following the Tournament of Books? If you're a regular, please join and give your support.

"We are witnessing a generation radicalize itself in real-time." In Nigeria, "cosmic anger" fuels the protest movement.

In Tanzania, populist President John Magufuli has presided over "a precipitous decline of the country's democratic experiment."

Stocks Have Worst Week Since March

As we head into Friday afternoon trading and the last trading day of October, the stock market is headed for its worst week since March of this year. Why? There are a few reasons, it's been a difficult week in which coronavirus cases are on the rise both here in the U.S. and Europe. U.S. […]

The post Stocks Have Worst Week Since March appeared first on INO.com Trader's Blog.

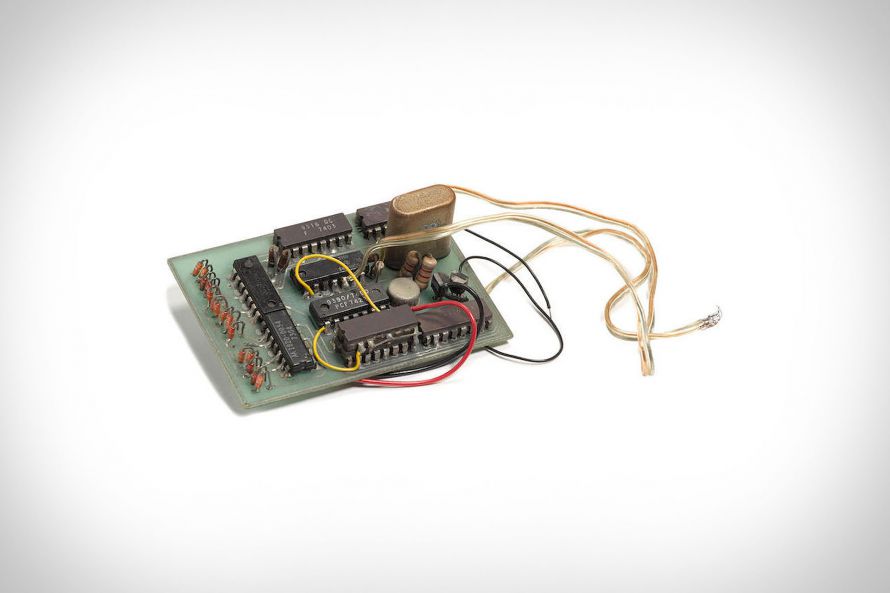

IPhones wouldn't exist without phone phreakers. An original "blue box" made by Steve Wozniak is up for auction.

A study finds the GOP now more closely resembles ruling parties in autocratic societies than its former center-right equivalents.

Pastel colors, trendy fonts, and conspiracy theories.

Wonder why your little sister is suddenly QAnon-adjacent? Blame pastel colors on Instagram.

Why do only some people get to feel secure? Georgetown’s Olúfẹ́mi O Táíwò on liberty, security, and racial capitalism.

With security in mind, it’s easier to see how focusing on the maximization of profit and plunder gets things wrong.

↩︎ Aeon

Big Tech Earnings Reaction Soft - Market Will Drop Into the Election

Sixteen years have led to this: it's the Championship match-up in the Super Rooster, presented by Bookshop.

A new top official hired to the Department of the Interior is associated with white nationalism.

What could or should full decolonization look like? Kenyans wrestle with erecting new statues and dismantling old ones.

In time for a pandemic Halloween, photographs of people in elaborate costumes at home.

Big Tech Earnings Reaction Soft - Market Will Drop Into the Election

Bitcoin – Can It Compete with Gold?

The last few weeks brought something interesting in financial markets – Bitcoin decoupled from two correlations that were valid for the entire year so far.

One was the negative correlation with the USD. Every time the USD rallied, it did so against Bitcoin. Or, when the USD was sold during a risk-on move, Bitcoin rallied.

The other one was against gold. This year Bitcoin and gold had a positive correlation. Since the March meltdown in the stock market that triggered an initial move lower on gold too, stocks corrected, and so did gold. Bitcoin followed gold closely and rose above $10k on gold surging above $2k.

Recently, however, Bitcoin seems to have a life of its own. The USD strengthened against the main fiat currencies – EUR, AUD, GBP, but failed to do the same against Bitcoin. Also, gold fell against the USD, but Bitcoin did not follow suit.

What caused Bitcoin correlations to break? More importantly, for how long will the decoupling last?

Important Developments in the Cryptocurrency Market

2020 will make history as the year when the pandemic hit. However, it is also the year when the cryptocurrency adoption increased the most. As such, one explanation for the sharp advance in Bitcoin to above $13k is the increased adoption.

It all started with MicroStrategy, a U.S. public company, revealing a Bitcoin investment worth over $100 million. Shortly after, another public company, Square, announced that it invested 1% of its total assets in Bitcoin. The last, and perhaps the most relevant news came from PayPal – the online payment giant announced that it would allow cryptocurrency payments at its over twenty million merchants around the world.

At that point, Bitcoin traded around $10k, and the news sent it much higher. The question that remains now – can Bitcoin compete with gold as an alternative investment? Or, even more importantly, can it replace gold?

Both assets have one characteristic in common – scarcity. Most gold in the world has already been mined, and there is also only a limited number of Bitcoins that will ever be mined.

Various models predict that Bitcoin will reach $100k as early as next year. This cannot happen unless Bitcoin decouples from its USD correlation, and the gold correlation continues. Otherwise, for Bitcoin to increase tenfold, the USD must decline aggressively, with irremediable damages to the financial system.

The post Bitcoin – Can It Compete with Gold? appeared first on Vantage Point Trading.

Apple Shares Tumble Despite Record Quarter

Shares of Apple declined after hours as the company revealed earnings for its fourth quarter of the fiscal year ended September 30th.

Despite a record quarter in terms of revenue ($64.7 billion), investors’ disappointment comes from iPhone sales missed and a declining Chinese market share that came at multiyear lows.

Sales for Mac and Services reached an all-time record, helping to conclude a remarkable fiscal year. However, despite rising revenues and rising diluted earnings per share metric, the rise in the sales of the iPad and Mac failed to make up for the decline in the iPhone sales.

Why Apple Sold After Hours?

Apple is one of the companies that benefited the most from the coronavirus pandemic. As people switched to remote working, Apple had the right product at the right time to help to build an adequate home office infrastructure.

All technology companies outperformed in the last six months, so the record quarter in revenue should not come as a surprise for investors. However, if one looks at the bottom line, Apple’s revenue was up only 1% in the last year, while its stock is up over 90% over the same periods. Therefore, the valuation might be viewed as a little too extreme when compared to what Apple actually delivered.

The company also declared a cash dividend of $0.205/share of the common stock, payable on November 12th 2020, to shareholders on record on November 9th, in line with prior on a split-adjusted basis, with a forward yield of 0.71%.

The timing for the release is not great. The stock market’s volatility increased lately as suggested by the VIX index, with only a few days left until the U.S. elections. Major stock indices reacted negatively to the lack of another round of fiscal stimulus before the elections. Despite both candidates hinting at an even bigger stimulus package to be delivered should they win, investors prefer a cautious stance until the results are known. In any case, despite the uncertainty, stocks remain new all-time highs in what appears just a longer consolidation until uncertainty dissipates.

All in all, Apple delivered an incredible quarter in terms of revenue. However, any company that trades at such high multiples will have a hard time justifying them if the revenue growth lags from previous performance.

The post Apple Shares Tumble Despite Record Quarter appeared first on Vantage Point Trading.

Algos make market thinner, but not less liquid – BIS

Thursday, October 29, 2020

"Pay someone's delinquent water bill if you have the means." A list of ways to make this Thanksgiving weird and great.

Fans of British Bakeoff will be happy to hear that Val and Selasi are still great friends.

I'm not a replacement mom, and it's not an Oedipus thing, nothing like that. Honestly. There's a saying that if you want to ask somebody a question, ask the person with the grayest hair, because they will probably give you a proper answer.

↩︎ The Atlantic

"These are strange times, and they cause us to do strange things." If you've ever wondered why a friend won't text you back.

"I was able to get people to understand who I am through dance."

From a recent profile of the dancer Lil Buck in the New York Times:

“I don’t even know if it could be called dancing, but I just jumped up and started moving around because I felt it so much,” he said in a recent interview from Los Angeles, where he lives. “There’s something about it that just hit me. My mom was like, ‘Oh my God, my son’s got the Holy Ghost!’”

Two stories about youth voting in this election.

"The youth vote in Texas is up by more than 600% from last presidential election," from KSAT

In Texas, as of Friday, 753,600 voters cast a ballot in the 2020 election. During the same time period in 2016, only 106,000 Texans younger than 30 had voted, according to the analysis, representing a 610% increase.

"Absentee and Early Voting by Youth in the 2020 Election," from CIRCLE (really good chart in this one)

In Florida, North Carolina, Maine, Minnesota, Pennsylvania, and Michigan, early votes cast by youth have already exceeded the 2016 margin of victory in that state's presidential race. More than five million young people (ages 18-29) have already voted early or absentee in the 2020 elections, including nearly 3 million in 14 key states that may well decide the presidency and control of the United States Senate.

Two ballot initiatives in Louisiana and Colorado "could preview a future without Roe v. Wade"

I

A study finds a number of sharks impaled by swordfish—backing up old fishermen’s tales of dueling marine predators.

This is a photograph of (very roughly) 10 million stars, give or take.

The argument that the threat of foreign influence operations targeting the United States has been overblown.

“To appear powerful and dangerous, all Russian actors need to do is make sure they are described as powerful and dangerous by credible sources in the United States. And for now… they are succeeding in doing just that.”

↩︎ Lawfare

Helen Branswell: It may be time to reset expectations on when we’ll get a Covid-19 vaccine.

Sweatshirts, mugs, and more still available for the Super Rooster, presented by Bookshop.

Pictures by Hungarian photographer András Ladocsi.

The True Economic Impact of COVID-19

Europe faces a tough recession generated by the COVID-19 pandemic. As the second wave hit the old continent, the economic growth perspectives declined too.

Small businesses are the ones that were hit the hardest by the pandemic. This impact is not exclusive to Europe, but in the United States too. In the last six months, the number of small businesses declined by 25% in the US alone. Considering what happened earlier this year, the second wave will likely bring much higher numbers in Europe.

New Lockdowns Affect Small Businesses

The big difference between Europe and the United States is that throughout Europe, governments intervened to support small businesses. For example, Germany just announced the closing of bars and restaurants for a month. However, at the same time, it announced a €10 billion injection to support the affected businesses.

In the United States, small businesses did not benefit from such support. All the Fed could do was to provide favourable lending conditions. But who wants to borrow in such uncertain times? As such, closing the business is more lucrative, at least until the world can control the pandemic.

The problem is that the small businesses sector employs a large number of people both in Europe and the United States. As such, the sector is a pillar for economic growth, and its health influences economic performance.

The second wave of the pandemic brought with it a significantly higher death toll across Europe. France, UK, Spain, Italy – they all reported this week their highest numbers since April/May. With the new restrictions already in place in all these countries, the first thing we will see is an impact on the oil demand.

As such, the price of oil will decline. This alone will trigger lower inflation, which will impact future economic growth too.

The point here is that the decline in the small businesses will likely continue, if not accelerate, moving forward. Of course, the social and economic consequences of the pandemic vary across countries and continents. Moreover, it appears that weather plays an important role. As winter reached Europe, people spend more time inside; favourable conditions for the spread of the virus when gathering in larger numbers. New lockdowns are inevitable – the big question is, for how long and what will be the final impact on small businesses?

The post The True Economic Impact of COVID-19 appeared first on Vantage Point Trading.

e-FX Awards 2020: Best compression/optimisation service for FX – TriOptima

Gold and How Prices Advance on a Logarithmic Scale

Gold is the only form of money that has survived for millennia. To this day, people argue about gold being money or not, but it depends a lot of the people’s interpretation of money.

While gold cannot be a unit of account, it does share one of the most important characteristics of money – store of value. Gold has retained its value over time, something we could not say about all the fiat currencies ever created.

When looking at a chart like the one below, one should always consider the currency too. In this case, this is the gold priced in $/oz. Does the chart reflect the parabolic rise in the price of gold or the incredible decline of the USD?

Gold as a Store of Value

Logarithmic charts display numerical data to respond to skewness to large values. Such charts are used to explain large market advances or declines, like the one in the price of gold against the USD.

If we replace the USD in the chart above with an emerging market currency (e.g., Turkish Lira – TRY), then the gold’s advance is even more dramatic. While gold appreciated against the dollar, the USD appreciated against other currencies. This makes the price of gold denominated in other currencies to increase even more.

An exchange rate expresses the value of a currency in terms of another. The same is valid when we talk about gold.

In 2020, the price of gold reached a record high against the USD. It broke the $2,000 on a steady USD decline as the Fed flooded the market with dollars in response to the coronavirus pandemic. This is one of the major milestones reached by the price of gold. However, in the grand scheme of things, it is literally a non-event. Looking at the chart above that shows gold’s price evolution since 1790, one thing is clear – every time the price of gold corrected, it was just an opportunity for investors to buy some more.

For this reason, it is recommended that any long-term portfolio has a portion invested in the price of gold. Some investors even build a cash position and hold it as speculative money, to be used when the price of gold declines.

The idea is that if history provides a clue about how the price of gold will perform in the future, owning gold would only increase the portfolio’s performance in the long run.

The post Gold and How Prices Advance on a Logarithmic Scale appeared first on Vantage Point Trading.